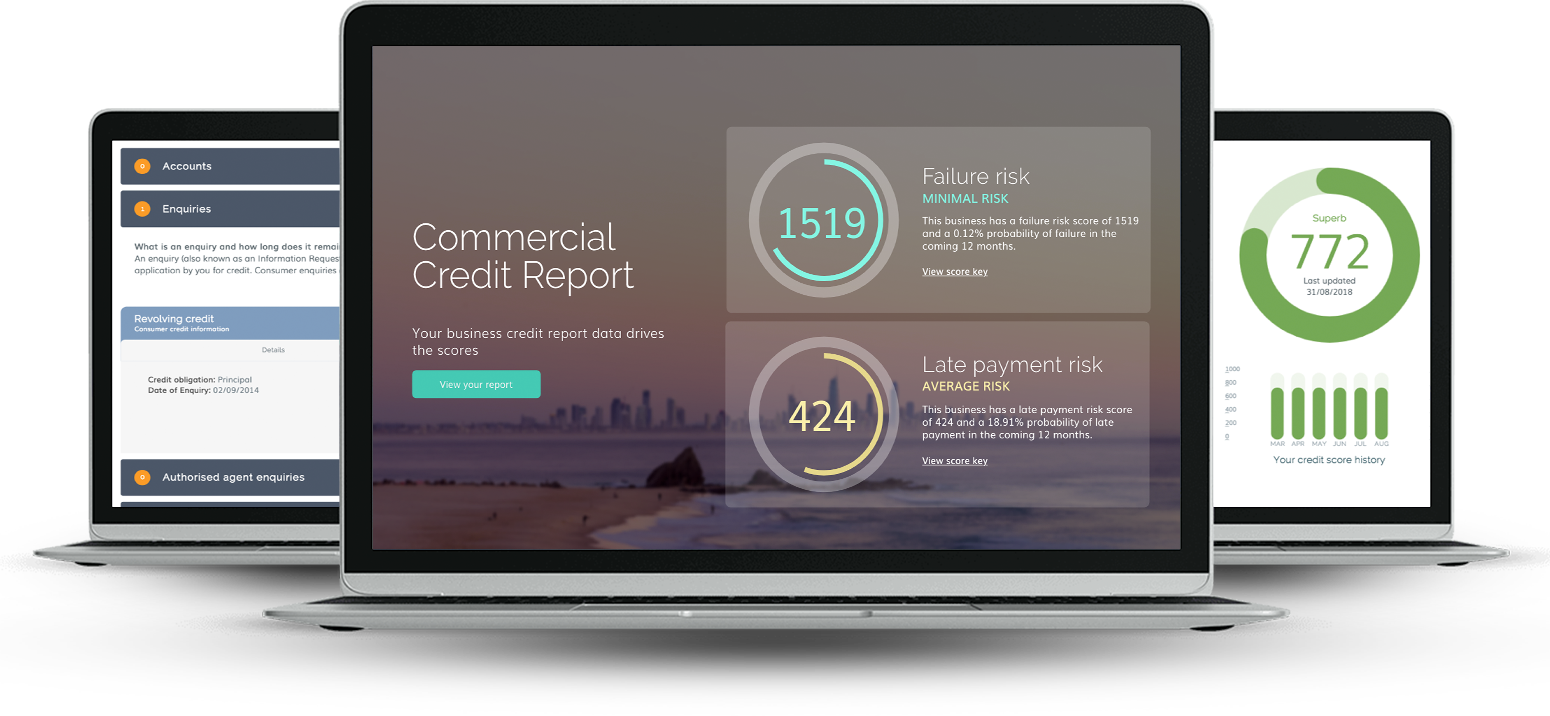

Australian Consumer Stress Barometer – March 2024

SYDNEY: New data released by credit bureau, illion, today as part of its Consumer Credit Stress Barometer for March 2024 shows that consumer credit stress fell (improved) in the second half of 2023 but is still 8% higher than two years…